Significant things to know about Input Tax Credits

Input tax credits:

Input credit referred as, at the time of paying tax on output, you can pay the balance amount and can reduce the tax if you have already paid on inputs.

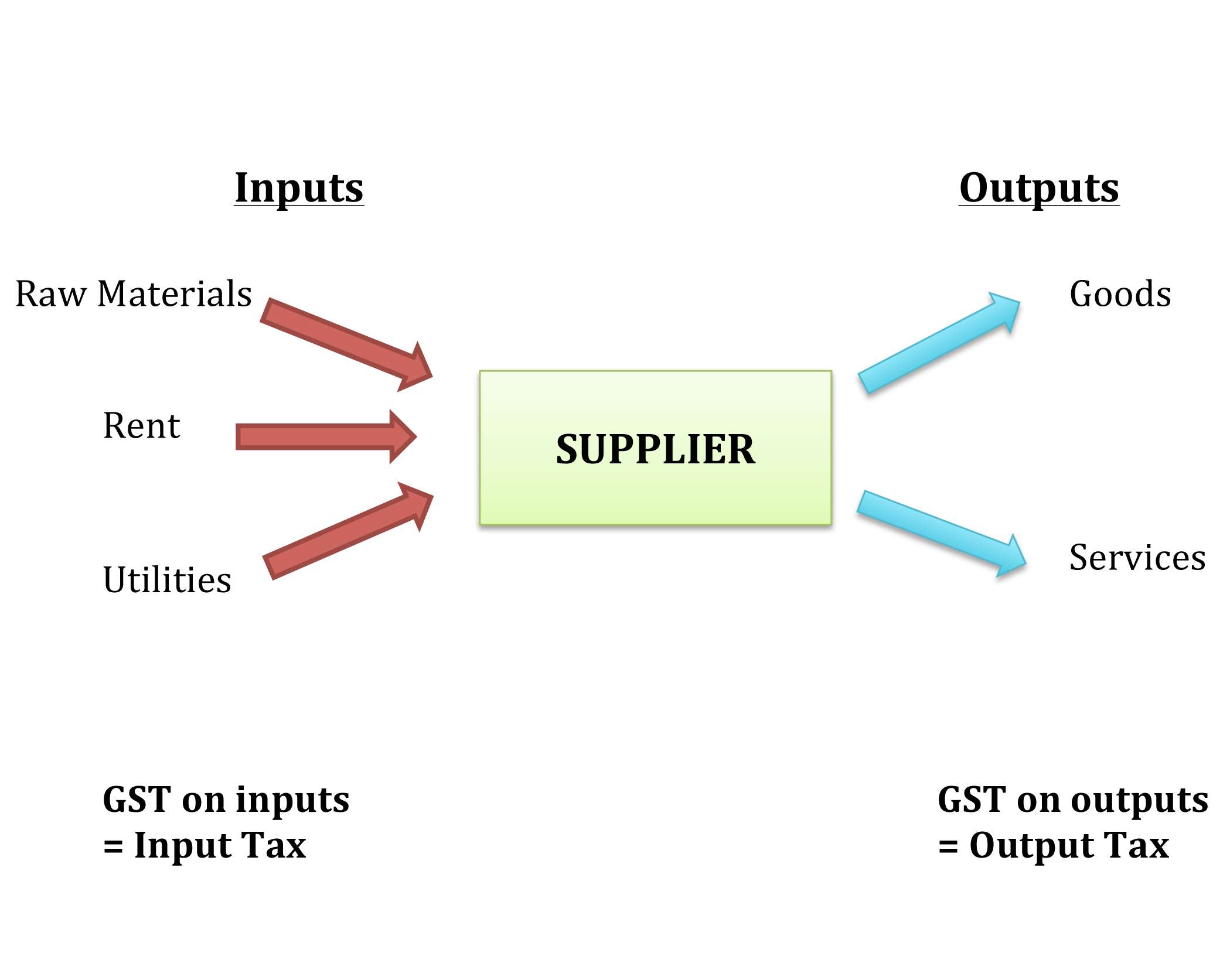

If you buy any products or services from a registered dealer, you pay taxes for that purchase. In the case of selling, you collect the tax.

Adjusting of taxes paid at the time of purchase with the amount of output tax which is tax on sales and the balance liability (tax on sales minus tax on purchase) that has to be paid to the government. This is what we called as “Input Tax Credit”.

For example – if you are a manufacturer

- Tax which is payable on output i.e., Final product is Rs.450.

- Tax paid on input purchases is Rs.300.

- Here, you can claim input credit of Rs.300 and you only need to deposit Rs.150 in taxes.

Who can claim ITC?

Input tax credit could be claimed by a person who is registered under GST only if he fulfills the conditions as given below:

- Returns need to be filed.

- The dealers need to possess the tax invoice.

- The said goods or services been received.

- The supplier pay the tax charged to the government.

- When goods are received in instalments, Input Tax Credit can be claimed only when the last lot been received.

- No Input Tax Credit will be allowed if the depreciation has been claimed on tax component of capital goods.

What can be claimed as ITC?

Only ITC can be claimed for business purposes. It will not be available on goods or services exclusively used for:

- Exempt supplies.

- Personal use.

- Supplies for input tax credit are specifically not available.

Reversal of Input Tax Credits:

Input Tax Credit is for goods and services that only can be availed for business purposes. If they are using for non-business or personal purposes, making exempt supplies of ITC cannot be claimed. There are some important situations where ITC can be reversed.

Input tax credit can be reversed in the following cases. They are as follows:

- Credit note issued to input service distributors by seller:

This is for Input service distributors. If a credit note is issued by the seller to the HO, then the input credit subsequently reduced would be reversed.

- Non-payment of invoices in 180 days:

Input tax credits will be reversed for invoices when it was not paid within 180 days of issue.

- ITC reversed is less than required:

After the annual return been furnished, this will be calculated. If the total input tax credits on inputs of non-business or exempted purpose are more than the ITC actually reversed during the year then the difference amount will be added to output liability. Interests will be applicable.

The complete details of reversal of ITC will be furnished in GSTR-2

- Inputs partly for business purpose and for exempted supplies or for personal use:

This is only for businesses which use the inputs for both the business and non-business (Personal use). Input Tax Credits been used in the portion of input goods or services used for the personal purpose that must be reversed proportionately.

Reconciliation of Input Tax Credit:

In the GST return, Input Tax Credit which is claimed by the person has to match up with the details specified by his supplier. After the filing of GSTR-3, in case any mismatch found, the supplier and the recipient need to be communicated regarding the discrepancies.

Required documents for claiming ITC:

- The supplier issues a debit note to the recipient (if any).

- Entry bill.

- The credit note or an invoice which is issued by the Input Service Distributor (ISD) as per the invoice rules under GST.

- If the amount is less than of Rs.200 or in case of reverse charge is applicable under GST law, invoice will be issued like the bill of supply.

- Supplier of goods and services is issued by the bill of supply.

All these documents need to be furnished at the time of filing the form GSTR-2.

Special cases of ITC:

ITC is available for capital goods under GST:

A critical aspect of the goods and services tax is the availability of input credit on capital goods which is used for manufacturing activities. Input credits for capital goods under GST have been prescribed that need to be followed strictly.

Since manufacturing contributes a major role to our nation Gross Domestic Product (GDP) and initiatives such as Digital India and Make in India which boosts that further.

The GST council agreed upon some rules which have been related to input credit, registration as well as other features of the tax.

ITC is not available for:

- Capital goods which are used exclusively for non-business i.e., personal purposes.

- Capital goods which are used exclusively for exempted goods.

There is no ITC will be allowed if the depreciation been claimed on tax component of the capital goods.

ITC on transfer of business:

This will be applicable in case of merging/amalgamation/transfer of business. At the time of transferring, the available input credits will be transferred from the transferor to the transferee.

Input Tax Credit provided by Input Service Distributor (ISD):

Input Service Distributor may be the branch office or a head office or any other registered office of a registered person under GST. Input service distributor collects the tax credits for all the purchases and distribute to all the recipients under different heads like SGST, CGST, IGST or cess.

ITC on Job work:

The manufacturer may send the goods for further processing to a job worker. For example: A shoe manufacturing company may send half-made shoes to the workers to fit and complete the balance portion. In such a situation, the principal manufacturer allowed to take the credit of tax paid on that purchase of goods.

ITC will be allowed when goods are sent to the job worker in both the cases:

- From the principal place of business.

- Directly from the place of supply of such goods.

“Solubilis Corporate Services”, who is a leading business service provider and been in this field for so many years. GST registration can be done within the specified duration of time and at an affordable cost. For more details -> Click here.